一、Macroeconomic Review: Employment is strong and expectations for interest rate cuts have cooled

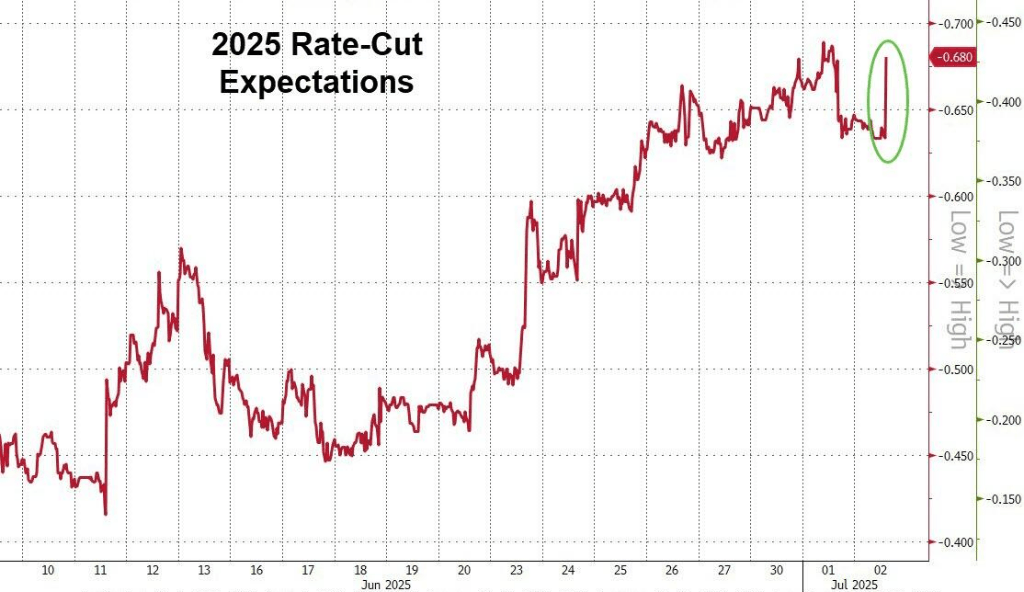

The US non-farm payrolls data for June released on July 3, 2025 showed that 147,000 new jobs were created and the unemployment rate unexpectedly dropped to 4.1%, which was better than market expectations. This data directly hit the market's bet on the Fed's July rate cut and reduced the expectation of a September rate cut from 98% to around 80%.

Although the average hourly wage increased by only 3.7% year-on-year (lower than the expected 3.8%), the overall data was sufficient to support the "temporary easing" monetary policy stance. Fed Chairman Powell said that "a July rate cut is still under consideration", indicating that the policy stance has become more neutral.

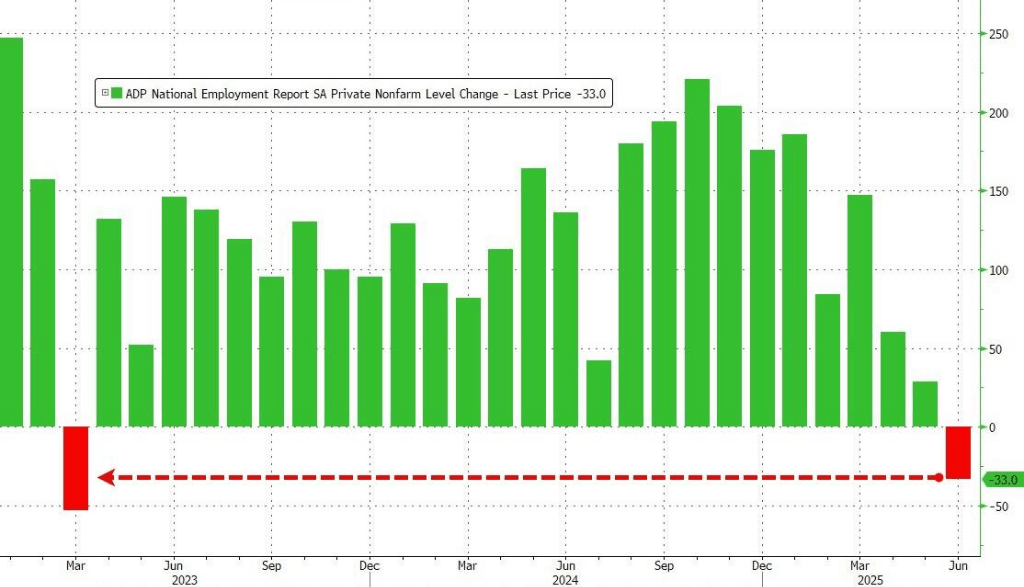

U.S. private sector employment unexpectedly fell sharply by 33,000 in June, marking the first negative growth since March 2023, with service sector employment suffering the largest drop since the outbreak. Market concerns about a weakening labor market have intensified.

On Wednesday, data released by ADP Research showed that U.S. ADP employment fell by 33,000 in June, compared with expectations of 98,000, while May data increased by only 29,000 after downward revisions. No economist had expected a decline before.

“While layoffs remain rare, last month’s job losses reflect businesses’ hesitancy in hiring and a reluctance to replace departing workers,” ADP Chief Economist Nela Richardson said in a statement.

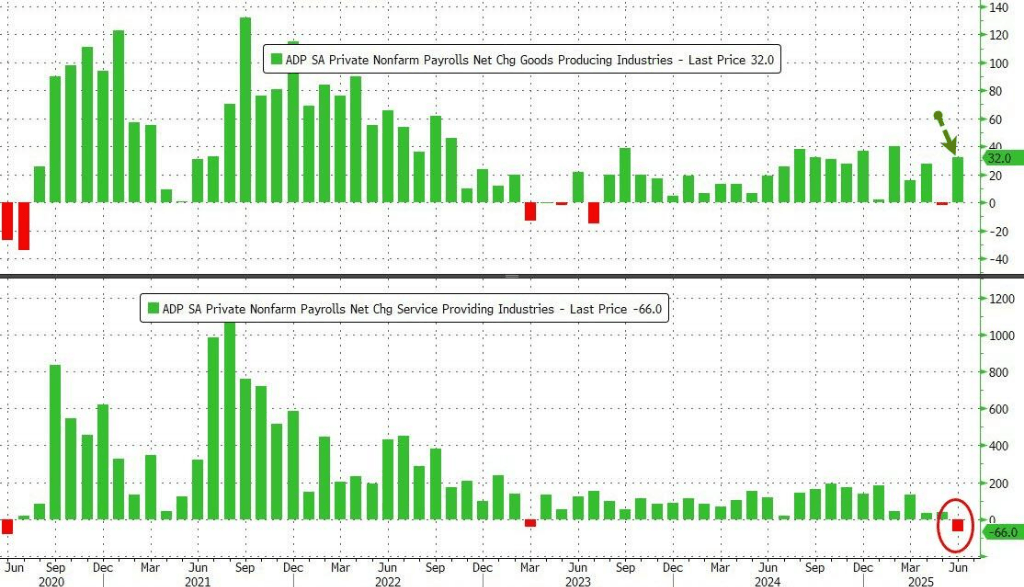

Private employment unexpectedly shrank in June, with the service industry under significant pressure

The report pointed out that in the face of the possible impact of the Trump administration's trade policies, American employers have become increasingly cautious and are redoubled their efforts to cut costs. Companies are currently focusing on adjusting the number of employees to better match the slowing economic activity this year.

Specifically, after a small decrease of 2,000 jobs in May, commodity-producing companies added 32,000 jobs in June. However, service industry employment decreased by 66,000 jobs in June, mainly due to declines in professional and business services as well as health care and education.

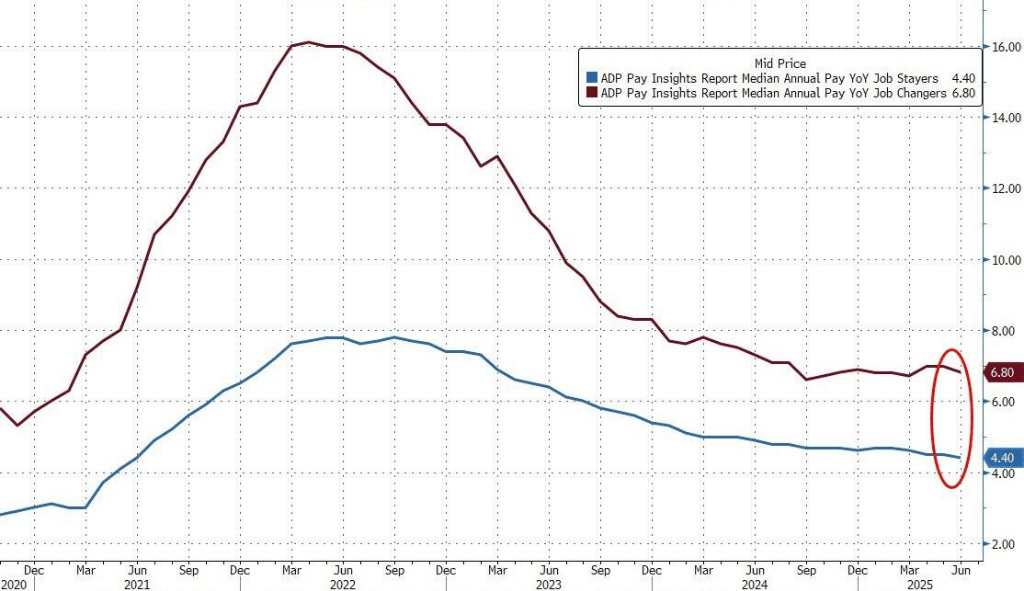

Wage growth momentum slows, the Fed faces a complex situation

Although the slowdown in hiring has led to fewer jobs, the momentum of wage growth has not been completely interrupted. Data showed that as of June, the year-on-year wage growth rate for employed employees was 4.4%, little changed from 4.5% in May. The wage growth rate for employees who changed jobs fell slightly from 7.0% last month to 6.8%.

Job growth has slowed to an average of 18,700 per month over the past three months, the weakest pace since the early days of the pandemic. Other data also support signs of weakness in the labor market:

⦁Unemployed people are taking longer to find new jobs;

⦁Hiring plans in June were the second-weakest since 2004, according to recruiting firm Challenger, Gray & Christmas;

⦁The share of consumers who said there were plenty of jobs fell to its lowest level in more than four years in June, according to the Conference Board.

Fed Chairman Jerome Powell has repeatedly reiterated that the labor market remains solid despite signs of a slowdown. Fed officials have refrained from cutting interest rates this year as they wait to see how tariffs affect inflation.

The market is closely watching the June non-farm payrolls report to be released on Thursday. UBS expects non-farm payrolls to increase by only 100,000 in June, and the unemployment rate may hit a new high in 2021; Citigroup expects non-farm payrolls to increase by only 85,000. If the June employment data is unusually weak, the Federal Reserve may cut interest rates as early as July.

After the data was released, traders increased their bets that the Federal Reserve will cut interest rates at least twice by the end of 2025.

二、Asset performance: Market prices reflect rapid switching of logic

Asset Class Performance Summary Drivers

US dollar index Up 0.39% to 97 The probability of the Fed cutting

interest rates in the short term

decreases

Gold spot It fell nearly $40 to $3,314.38 per ounce Real interest rate expectations rise,

and safe-haven demand declines

US stock index S&P 500 flat, small-cap stocks gain strongly The market fluctuated, and small-

cap stocks received style rotation

funds inflow

Bitcoin Breaking through $110,000, then falling back Q2 ETF holdings supported, but

risk appetite was suppressed

三、Major asset class investment outlook

1. Gold: Long positions pull back, waiting for inflation verification

⦁Analysis point of view: Gold has entered the overbought area in the short-term technical aspect, and the non-agricultural data provides an opportunity for a correction. The Fed's postponement of interest rate cuts against the backdrop of falling unemployment will push up expectations for real interest rates, putting pressure on gold prices.

⦁Focus: If the CPI data falls next week (<3.2%), the market may re-price the September rate cut, and the gold price is expected to retest above 3350.

⦁Strategic advice: Short-term pullbacks are seen as mid-term buying opportunities, and it is recommended to deploy in batches in the range of US$3310-3275/oz.

2. US stocks: Structural differentiation continues, small-cap stocks usher in a window for speculation

⦁Analyst’s view: Although the “delayed rate cut expectations” have suppressed overall valuations, the medium-term trend of U.S. stocks will still benefit from the relative resilience of the U.S. economy and upward revisions to corporate earnings expectations.

⦁Style switching: High-valuation technology stocks (especially the "Big Seven") are facing valuation suppression, and small-cap stocks (such as Russell 2000) have periodic opportunities due to their relatively low valuations and the support of the manufacturing return story.

⦁Industry configuration:

⦁Overweight: Financials, Small Manufacturing, Medical Equipment

⦁Neutral: Technology, communications services

⦁Selling: Non-core consumer, pure growth software

3. Interest rate market: The rate cut was eliminated in July, but there is still a high probability of a rate cut in September

⦁Policy judgment:

⦁Current data does not support a July rate cut;

⦁The Fed still needs CPI, job turnover and wage growth to cool further.

⦁Strategic recommendations:

⦁Long-term interest rates (10Y) may test 4.55–4.70%;

⦁Bond holdings remain neutral and defensive, and we tend to wait until the data becomes clear before making directional trades.

4. Crypto assets: ETFs boost reserve logic, but the “Federal Reserve anchor” is still there

⦁Highlight data: U.S. companies' Bitcoin holdings increased by 131,000 in Q2; ETF holdings increased by 8%.

⦁Investor interpretation: The current driving force behind Bitcoin's rise has shifted from "price game" to "asset reserve logic", especially its alternative storage function in inflation expectations.

⦁Risk warning: If interest rates remain high for a longer period of time, the risk appetite for crypto assets will be limited and it is necessary to guard against pullbacks.

⦁Strategic advice: Control leverage, and consider investing in Bitcoin ETFs (such as IBIT and FBTC) instead of direct currency allocation when there is a pullback.

四、Special attention events

July 10 US June CPI data

July 30-31 FOMC meeting and Powell speech

August Jackson Hole Global Central Bank Annual Meeting

五、Conclusion: The trading rhythm is reshaped, and it is advisable to have both offense and defense in summer

This round of non-farm data once again confirmed the "misalignment" tension between economic resilience and market expectations, put pressure on highly leveraged assets (gold, growth stocks), and strengthened the trading theme of "observing data and dynamic game".

EverStone Capital maintains its judgment on the "structural shock + thematic rotation" of the asset market in Q3 2025. Investors are advised to remain flexible and control their positions in the tug-of-war between "inflation cooling" and "policy lag", and wait for clearer signals before making trend bets.